A good summary of what might lie ahead in 2024...

Canada must face the facts: China is now closed for business

Charles Burton is a senior fellow at the Macdonald-Laurier Institute, non-resident senior fellow of the European Values Center for Security Policy in Prague, and former diplomat at Canada’s embassy in Beijing.

For more than 40 years, Canada’s business-political complex of interests have yearned to cash in big time by getting privileged access to China’s enormous market and global economic heft. Now, with the nightmare of the Michaels Kovrig and Spavor well in the past, Canada could be tempted to resume old patterns of China relations.

However, it is important we don’t. Canada must face the facts: China is now closed for business.

2023 has afflicted China with alarming concerns, including deflation, a terrifying crash in real estate, falling domestic consumer demand, and youth unemployment so bad that Beijing simply stopped reporting it. Foreign investment plummeted as overseas investors pulled billions out of China, seeking better returns elsewhere. (Canada “suspended indefinitely” our involvement in China’s Asian Infrastructure Investment Bank.)

By November, anxious to reset the economic clock, Chinese leader

Xi Jinping agreed to publicly meet U.S. President

Joe Biden on the sidelines of a conference in San Francisco. News media around the world posted pictures of the two rivals shaking hands through terse smiles. The imagery fuelled hopes that Washington and Beijing would resolve tensions which had led the U.S. to slap painful tariffs and restrictions on Chinese imports, including bans on commodities associated with forced labour in China. Beijing particularly wanted the U.S. to remove export bans on sophisticated American high tech, especially computer chips.

But, six weeks after the California photo op, none of that is happening. During his visit, Mr. Xi also held a lavish banquet to convince U.S. business moguls that the time is right for reinvesting in China. That, too, fizzled; the billionaires weren’t buying Mr. Xi’s reassurances.

Canadian business and investors should not expect prospects with China to improve any time soon, for various reasons.

To mute domestic disgruntlement over the economy, Mr. Xi might play the nationalism card through military engagement in the South China Sea and Taiwan as soon as 2027. As well, the regime has been reaffirming its Leninist core through renewed predominance of state-controlled enterprise over successful capitalists, to the extent that large Chinese companies have developed PR plans to respond to sudden “disappearances” of their chief executives.

Foreign businesspeople embroiled in arbitrary commercial disputes are increasingly denied exit from China until they comply with demands from Chinese state counterparts. And there are ever more controls and restrictions on security of business data, including bans on foreign businesses in China sending information to servers outside the country.

Then there are growing concerns about China’s political stability, as evidenced by the purge in 2023 of the Foreign Minister, the Minister of Defence and a range of senior military figures. This can’t be good.

But even as Beijing scrambles to stabilize its foundations, the West cannot become smug. China is a superpower in full sprint to achieve global dominance on many fronts, from asserting control over vital international shipping lanes; to establishing unrivalled military capabilities on Earth and in space; to working with Russia and other like-minded anti-Western states by using disinformation campaigns and other interference schemes to support extremist, populist parties in countries from Argentina to the Netherlands – the crowning glory being the possible return to power of

Donald Trump.

As for the Canadian government, 2024 will demand a tightrope walk of tact and strategy as it rebuilds vital planks of foreign policy. Events of the past year have left Ottawa with the complex task of rehabilitating economic and diplomatic relations with both China and India – two powerful adversaries with their own thorny relationship.

India will soon surpass China as the world’s most populous nation. It is critical that the West works much harder to keep India’s democracy from morphing into full alliance with the autocratic China-Russia-Iran axis.

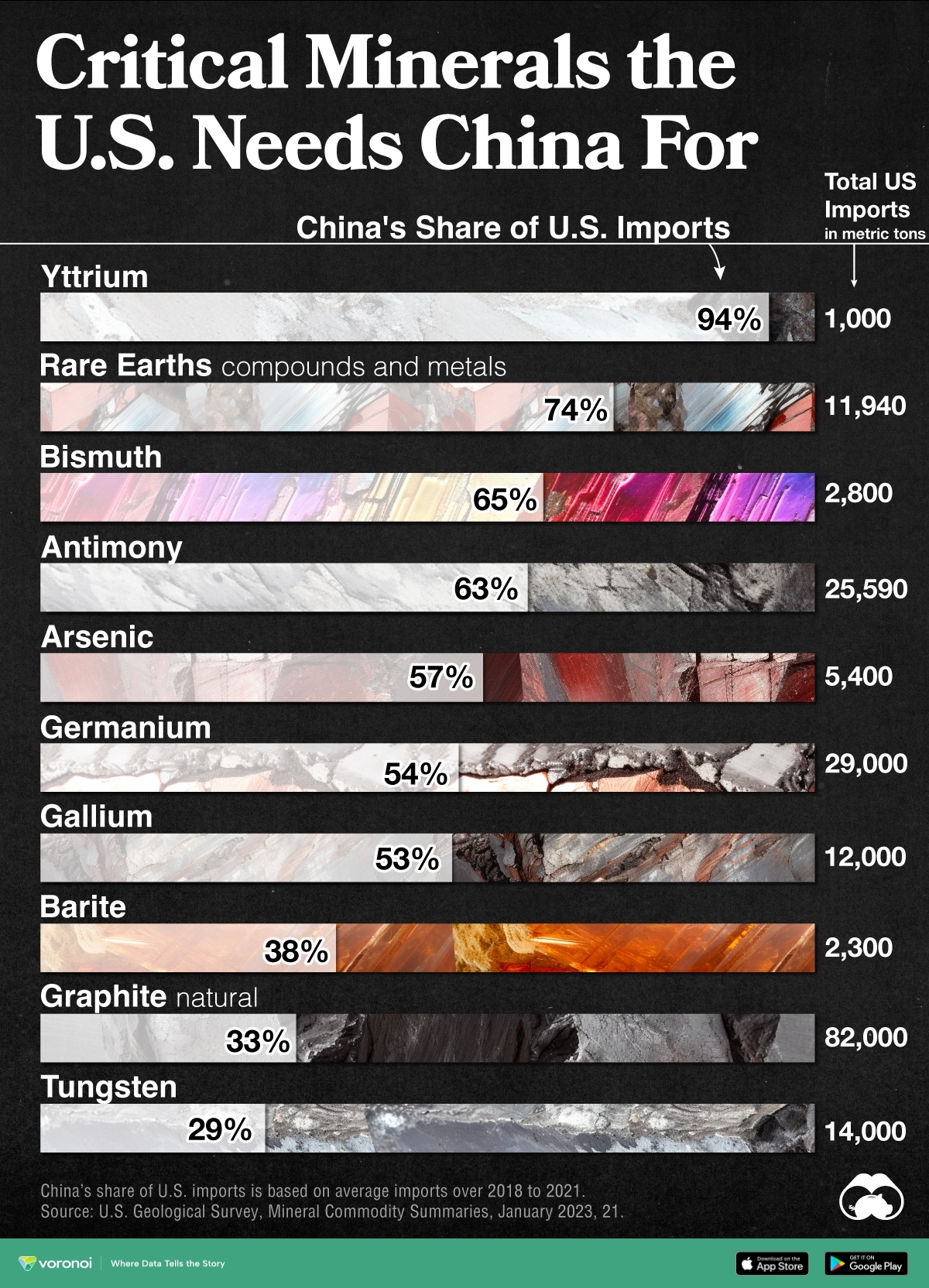

For Canada, government and business need to collaborate with urgency to achieve greater integration into the Indian economy, in the process reducing our dependence on China. As the world clamours for Canadian critical minerals and energy resources, our response has been dismayingly weak. Ottawa must be much clearer on where Canada’s interests lie – to our long-term peril, if we don’t.

We seem to have come to the age of the “traditional” Chinese curse, “May you live in interesting times.” As a philosophy major at university in China long ago, I could never find the Chinese source for this saying. But, today, it applies to Canada as we enter 2024.

Canadian business and investors should not expect prospects with China to improve any time soon, for various reasons

www.theglobeandmail.com

www.theglobeandmail.com